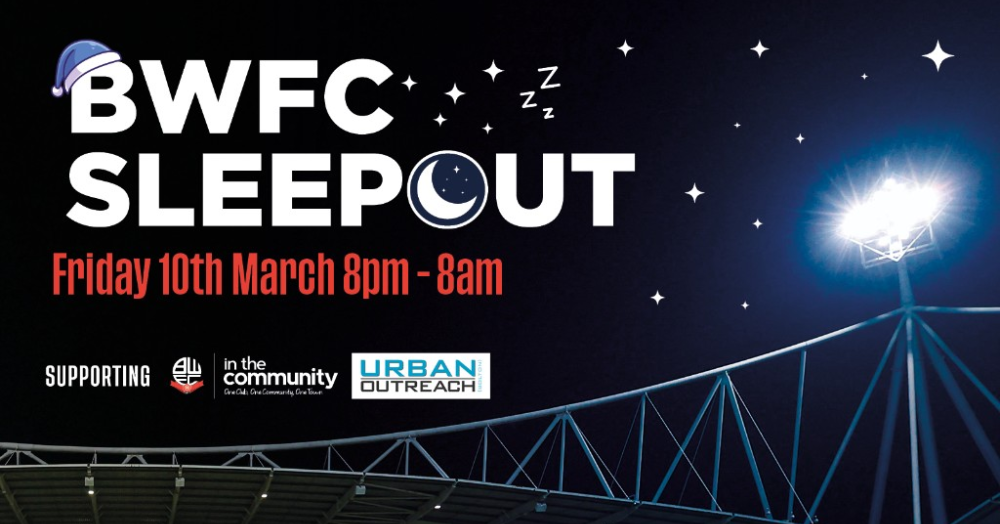

Claire & Matt at Harrisons are taking part in the BWFC SLEEPOUT!

If you want to move in 2026, positioning yourself as a serious buyer is essential. Here’s how to put yourself ahead of the competition and be taken seriously by sellers.

Selling a family home is about more than moving, it’s about managing a transition with clarity, care and confidence. Here’s how to approach your move in early 2026 with less stress and more ease.

The Bank of England has cut the base interest rate to 3.75% for the fourth time this year. While it won’t change the market overnight, it does shift confidence — and confidence is what gets buyers moving and homes sold.

Want first access to the best homes in 2026? Discover how our tech-led Heads Up Property Alerts help you see properties before they reach Rightmove—so you never miss out on your dream home again.