It’s about finding a trusted advisor, not a fairy godmother.

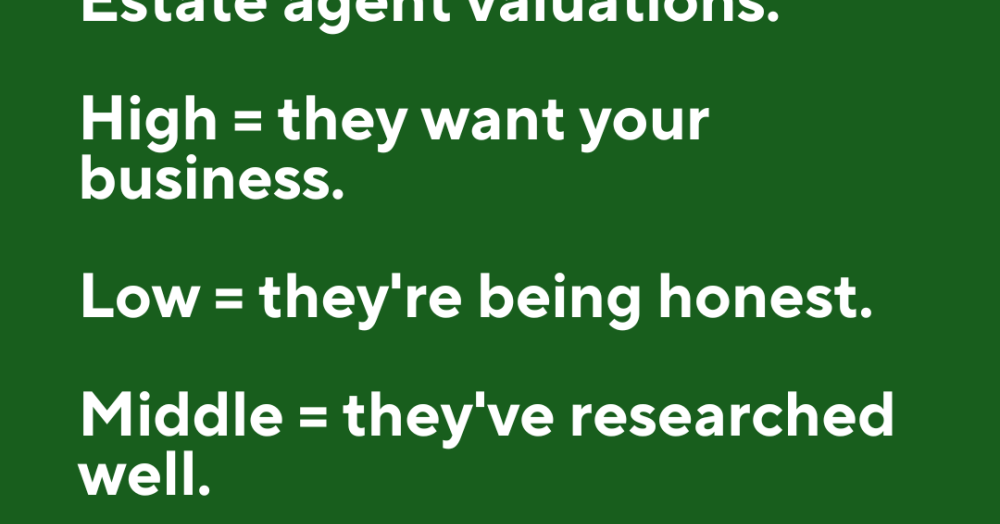

Understanding Estate Agent Valuations

Homeowners, navigating the property market can be challenging, especially when faced with varying valuations from estate agents. Some agents may provide inflated valuations to win your business, but this can lead to disappointment when your property doesn't sell.

In fact, only 53% of UK homes that left UK Estate Agent's books in the last year actually ended up sold and homeowner moved (the other 47% came off the market, unsold).

🔍 Here’s a quick guide:

- High Valuation: Often a tactic by some Estate Agents to gain your business. Be cautious.

- Low Valuation: Indicates honesty and realistic market understanding.

- Middle Valuation: Reflects thorough research and balanced insight. The 'Goldilocks Valuation'

Remember, choosing an agent who offers a realistic and well-researched valuation is crucial.

It’s about finding a trusted advisor, not a fairy godmother.

An honest and accurate valuation leads to a successful sale, avoiding the frustration of an unsold property. Make an informed decision and partner with an agent who prioritises your needs and market realities.