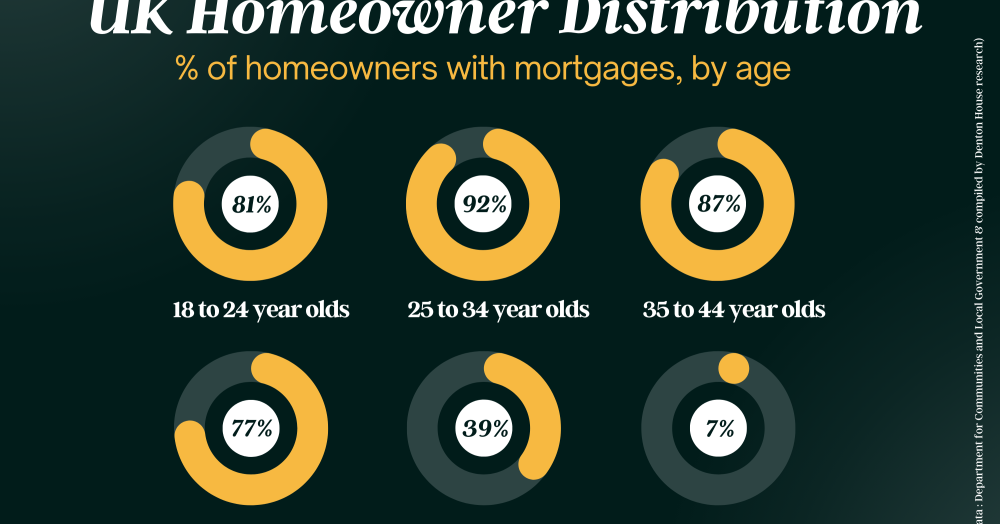

Percentage of Homeowners with Mortgages, across different age groups.

New Year, fresh goals, if moving home by spring 2026 is on your list, now’s the moment to plan. Understand how long properties took to go under offer and complete in 2025, and the key steps you need to hit your timeline. Read on to map out your best move ever.

Thinking of renting out your home? With major rental reforms arriving in 2026, the days of private, informal lettings are over. Here’s what every homeowner needs to know to stay compliant, protected and prepared.

Managing a probate property while coping with loss can feel overwhelming. This gentle guide explains the key steps, realistic timescales for 2026, and what to expect when selling a home as part of an estate.

Selling a family home is about more than moving, it’s about managing a transition with clarity, care and confidence. Here’s how to approach your move in early 2026 with less stress and more ease.