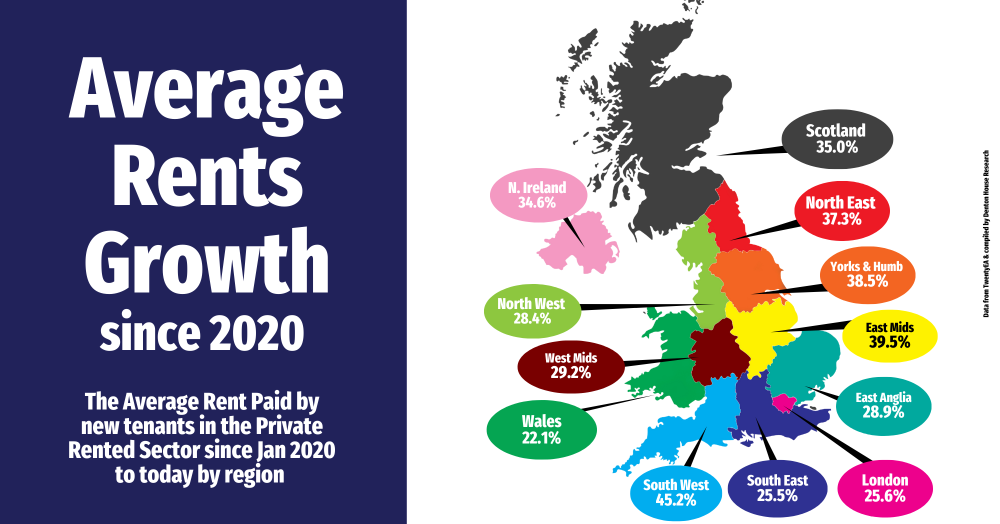

Rent growth since 2020

This growth in average rents is most pronounced in the South West, which has seen a remarkable rise of 45.2%.

Good news for Bolton landlords and Bolton tenants

The latest data on rent growth since January 2020 highlights significant increases across the UK, providing a promising outlook for landlords, especially those in Bolton

This growth in average rents is most pronounced in the South West, which has seen a remarkable rise of 45.2%. Close behind is the East Midlands with a 39.5% increase, and Yorkshire and the Humber with a 38.5% rise. The North East also shows a substantial growth of 37.3%, while Scotland’s rents have grown by 35.0%.

In Northern Ireland, there has been a 34.6% increase, whereas East Anglia’s rents have gone up by 28.9%. The North West and West Midlands have experienced rises of 28.4% and 29.2% respectively. London and the South East, despite being high-cost areas, have relatively moderate increases of 25.6% and 25.5%. Wales has seen the smallest growth in this period, at 22.1%.

For landlords in Bolton, this trend indicates a robust investment climate in the rental market. It’s important to note that these figures reflect the rents paid by new tenants. Existing tenancies have not seen such dramatic rises, as government data shows much lower increases for ongoing existing leases.

This means that while landlords can capitalise on the current market conditions, it is crucial to consider the broader tenant base to maintain good relationships and avoid unnecessary friction.

For more information or to discuss your property needs, be you an existing/potential new landlord or tenant feel free to contact us at allrentals@harrisonsnet.co.uk